Changing Your Tax Banding Questions

Sometimes your circumstances at work can change and you may find yourself unexpectedly returning to the UK for work reasons, compassionate leave or a training course. This could reduce your number of days spent outside of the UK, and ultimately affect your entitlement to SED at the end of the year.

With Zero Tax Banding your entitlement remains intact and your take home pay is not affected, regardless of any alterations to your work schedules.

Yes. Follow the steps to get your tax back every month and submit the forecast form through our portal. You must have a twelve month employment contract to submit the forecast form.

We will submit your application to HMRC who will issue a zero tax banding to you employer, which orders them not to deduct income tax from your pay each month. We can also recover any tax you have paid up to the date you have your Tax banding changed.

Follow the steps to change your Tax Banding to Zero and submit the forecast form through our portal. You must have a twelve month employment contract to submit the forecast form.

We will submit your application to HMRC who will issue a zero tax banding to you employer, which orders them not to deduct income tax from your pay each month.

Not less than six weeks.

The timing depends on your circumstances. If you have claimed a rebate before, it is reasonably straightforward.

If you are a brand new seafarer and not in the system yet, it can take much longer.

Each application is dealt with on an individual basis.

For as long you remain with the same employer.

Follow the same steps as before to change your Tax Banding to Zero. We will submit your application to HMRC who will issue a zero tax banding to your new employer, which orders them not to deduct income tax from your pay each month.

Yes. We can submit a tax return for you at the end of the year and recover any tax previously paid.

Contact us at admin@cfarertax.com for guidance on self employment.

Yes.

Your ‘Personal Allowance’ is £12570, which is the amount of income you do not have to pay tax on.

We can reclaim any tax you have paid, up to your Personal Allowance.

Yes, if they can be considered your employer. They will need to provide you with a payslip or P60

showing an employers reference number.

If it is a new position and you have less than three rotations, or none at all, follow the steps to get your tax back every month and submit the forecast form through our portal. You must have a twelve month employment contract with the agency or six months sea time to submit the forecast form.

If you don’t have a contract of employment for twelve months but have reached the qualifying

period of working outside of the UK for 182.5 days out of 365 follow the steps to Claim Your Tax

Back for The Year.

No.

You can apply for a Zero Tax Band at any time if you have a 12 month contract of employment.

Follow the steps to ‘Get your tax back every month’ and submit the Forecast Form on our portal.

Your employer will deduct tax from your pay for the six week period, and the your home leave period after that. Once you return to overseas work, your Zero Tax Banding will instantly revert. At the end of the tax year, we can recover any UK tax paid by utilising your personal allowance.

Provided the information you have entered is accurate and true, we will continue to act on your behalf to obtain the Tax Banding change.

Yes. The Zero Tax Banding only applies to one employer at a time.

Yes. Please contact us at admin@cfarertax.com

Annual Tax Rebate Questions

Follow the steps to Claim Your Tax Back For a Year. We will submit your claim to HMRC for a full rebate.

We can also change your Tax Banding to Zero so you will no longer pay tax on your seafarers earnings

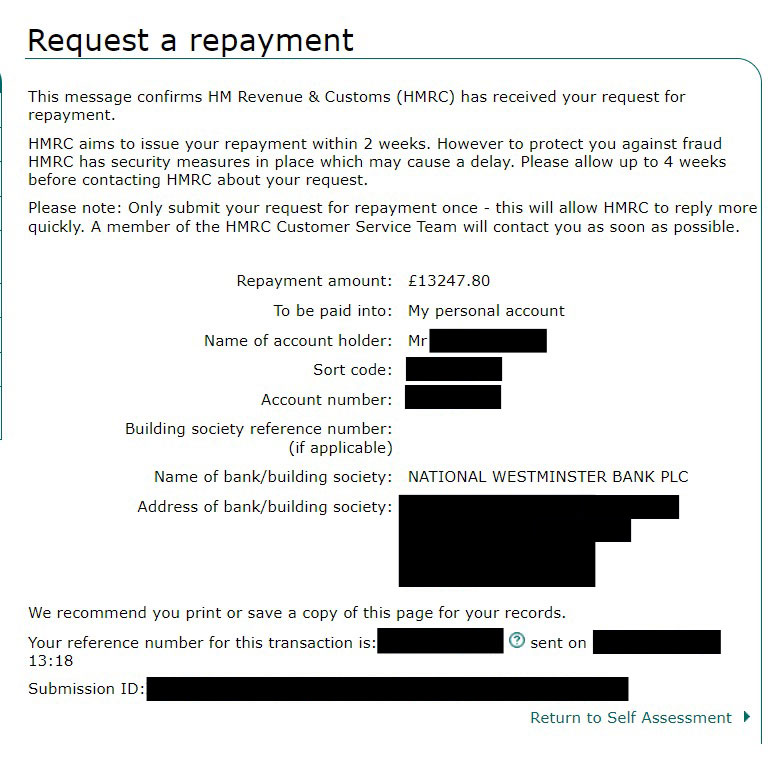

Once submitted, and confirmed, pay-out is usually two weeks, but we are requested not to contact HMRC until four weeks have passed.

See example letter from HMRC:

No, you cannot start a full rebate claim until you have reached the minimum qualifying period of 365 days. But you can apply for a Zero Tax Band if you have a 12 month contract of employment. Follow the steps to Get Your Tax Back Every Month and submit Forecast Form on our portal

Yes. Follow the steps to get your tax back every month and submit the forecast form through our portal. You must have a twelve month employment contract to submit the forecast form.

We will submit your application to HMRC who will issue a zero tax banding to you employer, which orders them not to deduct income tax from your pay each month. We can also recover any tax you have paid up to the date you have your Tax banding changed.

Yes. We can submit a tax return for you at the end of the year and recover any tax previously paid.

Yes. We can go back three years for a Seafarers Tax Rebate.

No.

Yes

if your earnings as a seafarer are liable to UK Income Tax and you are:

• resident for tax purposes in a European Economic Area (EEA) State and

• not ordinarily resident in the UK

you can claim SED.

Contact us at admin@cfarertax.com